Budget and Business Plan

Ware Town Council sets an operating budget each January for its day-to-day operations and to support projects for the financial year commencing in April. The Council is the sole managing trustee for The Priory Charity.

They operate The Priory Charity under a management agreement and allocate funds towards the running and upkeep of the Priory Estate including the Priory Building, Fletchers Lea, the Lido, Play areas and Skatepark, Public toilets and the wider Priory Grounds. See below to view the current and previous year’s budgets.

Every four years, the Council also develops a Business Plan which is the blueprint for what it will focus on over that period. It aims to give a clear picture to residents, stakeholders and partners as to what the Council is trying to achieve and how it intends to go about it.

2024/25

These files may not be suitable for users of assistive technology and are in the following formats: .pdf. Request an accessible format.

2023/24

These files may not be suitable for users of assistive technology and are in the following formats: .pdf. Request an accessible format.

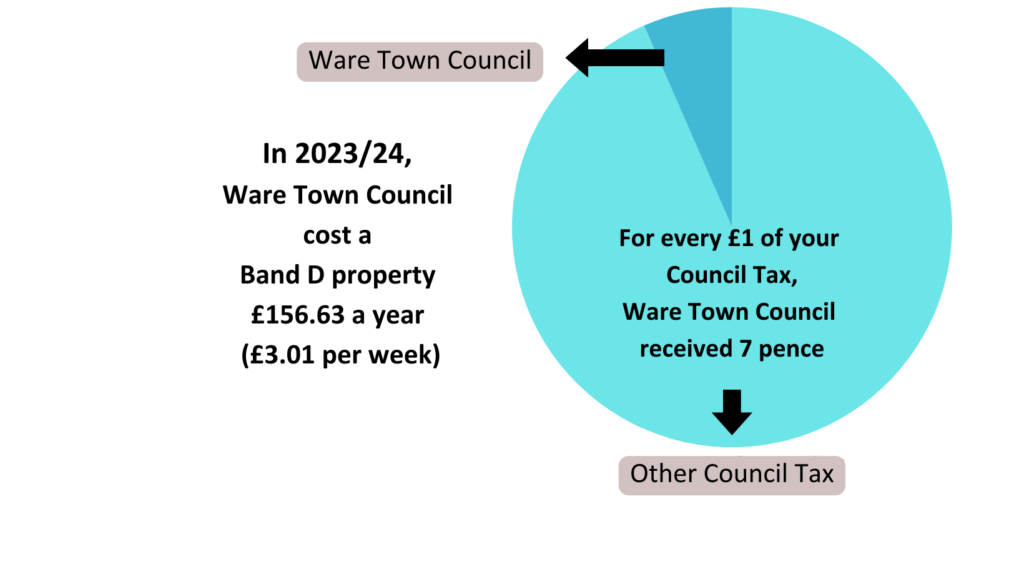

Council Tax Ware Town Council Share

Ware Town Council’s total precept for 2023-24 was £1,184,929. The cost to a Band D property was £156.63 for the year (or £3.01 per week), which represents a sub-inflationary increase of 3.9% (the increase the previous year was 3%).

The Council Tax paid by Ware residents includes the spending requirements of Hertfordshire County Council, East Herts District Council, Hertfordshire Police Authority and Ware Town Council. The District Council is the charging authority responsible for collecting your Council Tax on behalf of all four authorities.

Ware Town Council receives neither revenue support from Central Government, unlike the District and County Councils, nor funding from local businesses and retailers through their business rates.

Ware Town Council is funded by Ware householders and from the income generated from the services we provide, for example Priory hospitality operation, Lido income, allotment rents and burial fees. Each year, the Town Council calculates the money it needs to raise to provide its services. We then deduct the income collectable from our activities to leave an amount we require to spend on services for the year ahead. This sum, called the Precept, is the amount the District Council collects on our behalf as a proportion of the total Council Tax paid by Ware residents. This is then paid to us in two instalments.

Payments Over £100

In this section we publish monthly updates detailing every amount more than £100 (excluding VAT) paid to suppliers. Prior to April 2024 the amount was £500. This is so we can achieve our aim of being transparent about how we spend your money. What we publish reflects the latest Government guidelines on public sector transparency.

The payment schedules include:

- The date of the payment

- The name of the supplier

- Details of the payment

- Net amount

2024/25

These files may not be suitable for users of assistive technology and are in the following formats: .pdf. Request an accessible format.

2023/24

These files may not be suitable for users of assistive technology and are in the following formats: .pdf. Request an accessible format.

2022/23

These files may not be suitable for users of assistive technology and are in the following formats: .pdf. Request an accessible format.

Standing Orders

Standing Orders are the written rules of a local Council. They are used to confirm a Council’s internal organisational, administrative and procurement procedures and procedural matters for meetings. They are not the same as the policies of a Council but they may refer to them. A local Council must have standing orders for the procurement of contracts. Click below to view.

This file may not be suitable for users of assistive technology and are in the following formats: .pdf. Request an accessible format.